快速查题-ACCA英国注册会计师试题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

'The use of residual income in performance measurement will avoid dysfunctional decision-making because it will always lead to the correct decision concerning capital investments.'

To prevent dysfunctional transfer price decision-making, profit centres must be allowed to make autonomous decisions. True or false?

Which of the following is not a disadvantage of using market value as a transfer price?

The following information relates to an investment centre, which is a separate product division in a large company.

$

Net current assets 60,000

Non-current assets 240,000

Profit before depreciation 50,000

Depreciation 10,000

The company's cost of capital is 10%. What is the most appropriate measure of the centre's Return on Investment (ROI)?

SWAL has two divisions, SW and AL, which operate as profit centres and have full autonomy in making, buying and selling decisions.

SW manufactures SW+ at a cost of $12 per unit. The market price of SW+ is $16 per unit.

AL uses SW+ in manufacturing its own product. The transfer price of SW+ when transferred from Division SW to Division AL is set at full production cost plus 20%.

Which one of the following independent circumstances represents dysfunctional behaviour arising from SWAL's transfer pricing policy?

This question appeared in the June 2015 exam.

A division is considering investing in capital equipment costing $2.7m. The useful economic life of the equipment is expected to be 50 years, with no resale value at the end of the period. The forecast return on the initial investment is 15% per annum before depreciation. The division's cost of capital is 7%?

What is the expected annual residual income of the initial investment?

This question appeared in the June 2015 exam.

At the start of the year, a division has non-current assets of $4 million and makes no additions or disposals during the year. Depreciation is charged at a rate of 10% per annum on all non-current assets held at the end of the year. Working capital is $0.5 million at the start of the year although this is expected to increase by 20% by the end of the year. The budgeted profit of the division after depreciation is $1.2 million.

What is the expected ROI of the division for the year, based on average capital employed?

This objective test question contains a question type which will only appear in a computer-based exam, but this question provides valuable practice for all students whichever version of the exam they are taking.

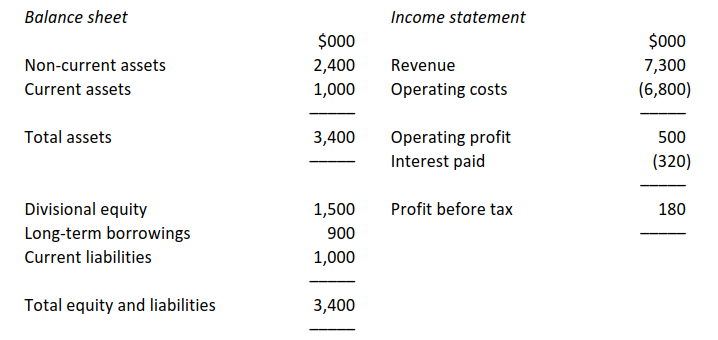

Summary financial statements are given below for JE, the division of a large divisionalised company:

The cost of capital for the division is estimated at 11% each year. The annual rate of interest on the long-term loans is 9%. All decisions concerning the division’s capital structure are taken by central management.

What is the divisional return on capital employed (ROCE) for the year ended 31 December?

This objective test question contains a question type which will only appear in a computer-based exam, but this question provides valuable practice for all students whichever version of the exam they are taking.

Pro is a division of Mo and is an investment centre. The head office controls finance, HR and IT expenditure but all other decisions are devolved to the local centres.

The statement of financial position for Pro shows net value of all assets and liabilities to be $4,500m. It carries no debt itself although the group has debt liabilities.

The management accounts for income read as follows:

$m

Revenue 3,500

Cost of sales 1,800

Local administration 250

IT costs 50

Distribution 80

Central administration 30

Interest charges 90

Net profit 1,200

Ignore taxation.

If the cost of capital is 12%, what is the division’s residual income?

This objective test question contains a question type which will only appear in a computer-based exam, but this question provides valuable practice for all students whichever version of the exam they are taking.

Pro is a division of Mo and is an investment centre. The head office controls finance, HR and IT expenditure but all other decisions are devolved to the local centres.

The statement of financial position for Pro shows net value of all assets and liabilities to be $4,500m at the start of the year and $4,890m at the end. It carries no debt itself although the group has debt liabilities.

The management accounts for income read as follows:

$m

Revenue 3,500

Cost of sales 1,800

Local administration 250

IT costs 50

Distribution 80

Central administration 30

Interest charges 90

Net profit 1,200

Ignore taxation.

What is the divisional ROI to the nearest % point?